ICO’s

An ICO or Initial Coin Offering allows a company to sell its own cryptocurrency token to investors. As William Mougayar (a true Blockchain expert) states:

A [cryptocurrency] token is just another term for a type of privately issued currency.

It’s probably fair to say that at this time raising funds via an ICO is relatively easy when compared to traditional methods. There have been many successful ICOs with large amounts of cash being generated. It’s also probably fair to say that a large amount of the companies running these have no real requirement for a token and are simply accessing the ‘easy’ cash.

Some experts predict the majority of ICOs will fail but the organisations with genuine token models (and good execution) will survive and these are the ones that are innovative, valuable and interesting.

Analysing The Token Model

My plan is to analyse companies that use tokens to basically answer the question:

What does the token do that makes it essential to the business model?

This should help me to better understand the technology and identify how tokens can be used.

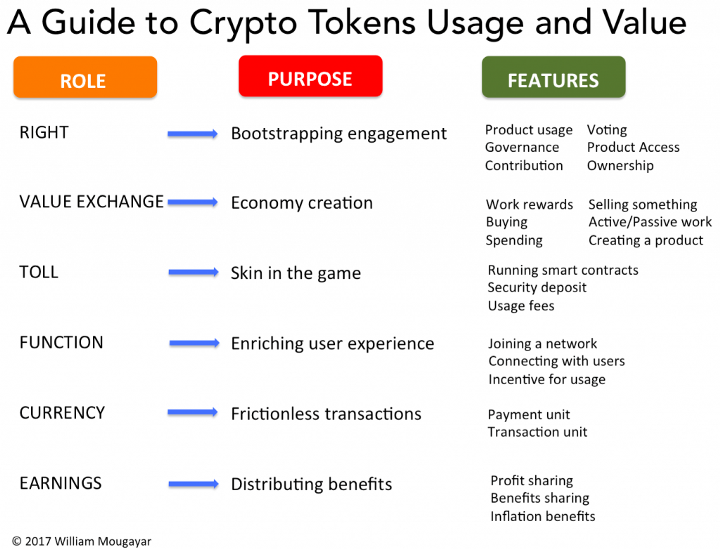

As a basis of the investigation I will use William Mougayars Role — Features — Purpose framework for assessing token utility as described in his post, Tokenomics — A Business Guide to Token Usage.

The chart shown below is taken from the Tokenomics post and shows the main roles a token can play. The post itself provides great detail that I won’t repeat but is definitely worth a read. Using this and the list of questions at the end should result in a reliable conclusion on the utility of the token.

Token Utility Questions (credit William Mougayar)

- Is the token tied to a product usage, i.e. does it give the user exclusive access to it, or provide interaction rights to the product?

- Does the token grant a governance action, like voting on a consensus related or other decision-making factor?

- Does the token enable the user to contribute to a value-adding action for the network or market that is being built?

- Does the token grant an ownership of sorts, whether it is real or a proxy to a value?

- Does the token result in a monetizable reward based on an action by the user (active work)?

- Does the token grant the user a value based on sharing or disclosing some data about them (passive work)?

- Is buying something part of the business model?

- Is selling something part of the business model?

- Can users create a new product or service?

- Is the token required to run a smart contract or to fund an oracle? (an oracle is a source of information or data that other a smart contract can use)

- Is the token required as a security deposit to secure some aspect of the blockchain’s operation?

- Is the token (or a derivative of it, like a stable coin or gas unit) used to pay for some usage?

- Is the token required to join a network or other related entity?

- Does the token enable a real connection between users?

- Is the token given away or offered at a discount, as an incentive to encourage product trial or usage?

- Is the token your principal payment unit, essentially functioning as an internal currency?

- Is the token (or derivative of it) the principal accounting unit for all internal transactions?

- Does your blockchain autonomously distribute profits to token holders?

- Does your blockchain autonomously distribute other benefits to token holders?

- Is there a related benefit to your users, resulting from built-in currency inflation?